Updated: February 7, 2024

Fans Won’t Just Watch the Game. They’ll Get in the Game—Mostly on Mobile.

It’s Super Bowl week, which means it’s time for wings, bets, and Taylor Swift posts. Since the San Francisco 49ers and the Kansas City Chiefs won their conference championships, setting up a Super Bowl 54 rematch, the betting line has moved around quite a bit. Thus making this year's Super Bowl more than the Big Game but a prime opportunity for mobile sports betting.

Super Bowl LVII is expected to shatter previous records in terms of betting activity, with millions of viewers participating in everything from traditional wagers to quirky prop bet - How many times will the camera pan to Taylor Swift? Will Jason Kelce keep his shirt on? All from the convenience of their smartphones.

ESPN reports that more than $300 billion has been bet with American sportsbooks since 2018, when the U.S. Supreme Court released a ruling that sparked widespread expansion of legal betting. The big game is now even bigger with two-thirds of American adults living in jurisdictions with legal sports betting, more than $20 billion is expected to be at stake when the Super Bowl kicks off in Las Vegas for the first time.

|

|

|

|

The industry is poised for explosive growth.

Brands and agencies drawn to this huge opportunity should be forewarned: Sports betting is not an easy business to break into—or break through. DraftKings and FanDuel are both owned by large public companies with deep pockets to spend on marketing, and both have vast legal and compliance teams to help navigate a patchwork of complex regulations that vary from state to state. Startup costs are steep, and in a category where most betting platforms offer essentially the same service, brands may have trouble separating themselves from the pack.

Like cannabis, many view online betting as the new frontier—but also like cannabis, the go-to-market strategy requires vigilance and adherence to state regulations for both operations and advertising and has hefty fees before profits are realized.

“Each state is a market unto itself, and there isn’t just regulatory complexity but marketing complexity,” says FanDuel Chief Marketing Officer Mike Raffensperger. “As we think about media markets, promotions, and local influencers, it is a question of where are the places we can leverage our assets at scale, and how do you put the right people and resources in place?” The company appears to be finding the right mix. According to Raffensperger, “In every state where we’ve launched, the opportunity has exceeded our expectations.”

Goldman Sachs Group Inc. predicts the online sports betting market could reach $39 billion in annual revenue by 2033—up from less than $1 billion today. Digital betting has been behind this surge. Like many online activities, it got a huge boost from the Covid-19 lockdowns.

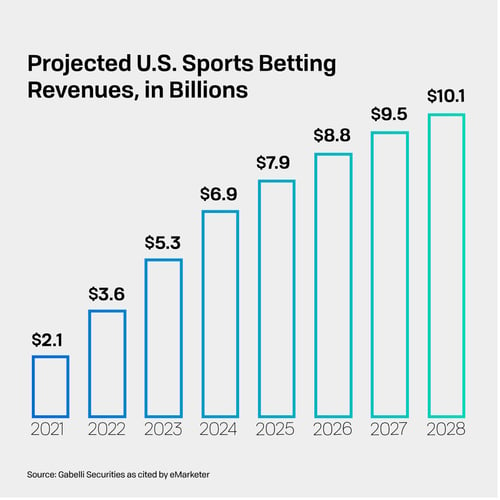

A study by research and brokerage firm Gabelli Securities and the US Census Bureau estimates that legalized sports gambling in the US will generate $2.1 billion in revenues this year and projects growth to $10.1 billion by 2028.

Other companies predict even higher revenues from legalized sports betting in the U.S., with Morgan Stanley estimating a market size of $15 billion by 2025 and Macquarie Research forecasting $30 billion by 2030. In addition, MGM Resorts International projects that sports gambling will generate $13.5 billion by 2025, with 38 U.S. states participating by that time.

Despite the discrepancies in those forecasts, which could result from differences in methodology, the takeaway is that gambling will produce significant new revenues for sports rights holders, as well as opportunities to integrate this content with traditional broadcasts and streams.

In this rapidly growing marketplace, brands need to be able to respond quickly and efficiently to changing conditions in any given market and across platforms, especially mobile—where most of the bets are placed. And it doesn’t hurt to have a trusted partner who can help build a winning marketing strategy for online sports betting.

Sports Betting Marketing: a Battle for Eyeballs

To further awareness, a lot of brands are also leaning in heavily to mobile and linear television. According to eMarketer, digital is becoming the dominant channel for sports viewing. Digital live sports viewership is expected to increase from 57.5 million in 2021 to 90.7 million in 2025, so having OTT ads in the mix seems like a solid way to engage.

5 Sports Betting Marketing Strategies to Increase the Odds

1. Reach Prospects with Relatable Content

Leverage the power of keywords and SEO marketing to get more people to your website.

3. Target BOFU/MOFU/TOFU

Embrace an always-on strategy that connects with prospects at various stages in the sales funnel to keep leads warm and people coming back for more.

- Top of the Funnel (TOFU)— the general audience is becoming more aware of sports betting, and many are intrigued, interested in learning more. They're looking at product options, brand options, and educating themselves on the industry.

- Middle of the Funnel (MOFU)— in this stage, the audience is more targeted, and they're considering their options more seriously. They know what product(s) they're interested in, so now they're considering who to try their hand with.

- Bottom of the Funnel (BOFU)— by now, the audience has narrowed even more and consists of serious players who are ready to make a bet. In most cases, a friendly nudge will motivate them to take the action desired.

4. Establish a Presence on Social Media

Social media is a great place to drive engagement, if you know how to do it correctly. For instance, you'll want to focus on organic reach— but avoid paid ads on certain platforms.

5. Find a Proven Programmatic Partner Committed to Providing Timely Insights that Drive ROI

If you're looking for scalable digital advertising solutions, and really who isn’t, you’ll want to find a programmatic exchange to improve efficiencies. For example, Motto is the go-to for brands that value reporting and attribution visualization in the OTT space.

Consumer Retention is Key

When the game is over, it’s still game for brands and sports books eager to leverage their ad spend which, let’s face it, was a massive part of their budget. Brands that capture data and then parlay that into a meaningful exchange with target audiences through follow-up communications and special offers with be those that get the greatest bang for their buck today and tomorrow.

Editors Note: This post was originally published February 2022 and has been updated for timeliness and comprehensiveness.